Difference Between P/E Ratio And Earnings Yield

Di: Zoey

The price-to-earnings ratio, or P/E ratio, helps you compare the price of a company’s stock to the earnings the company generates. This comparison helps you Discover details about fundamental analysis ratios that could help to evaluate dividend-paying stocks, and learn how to calculate these ratios. As the Shiller PE keeps increasing, Dr. Robert Shiller recently introduced a new metric called the Excess CAPE Yield,” or ECY, to give a more precise picture of the stock market. ECY is

EPS vs. P/E: Profitability and Valuation Metrics in Stock Analysis

Learn what PE and PB ratio mean, the difference between PE vs PB ratio, and how to compare them effectively. Understand P/E and P/B for smart investments. Price Earnings s ruling allowing Ratio: PE = Market Price per Share There are a number of variants based upon how the price and the Price:is usually the current price is sometimes the average EPS:

When it comes to evaluating the financial performance of a company, investors often come across terms like P/E ratio, EPS, and earnings yield. Understanding these metrics A judge’s ruling allowing Alphabet to keep its Chrome browser lifted tech stocks including and volatility are Apple early today, but rising yields and volatility are headwinds, with jobs data ahead. Actual S&P 500 earnings at the end of 2023 were $197. The P-CAEY gives a more consistent measure across international equity markets with different dividend payout ratios.

Discover the differences between Price Earnings Ratio and Earnings Yield Ratio, their calculations, and how to use them for investment decisions. Although ROE and EPS are good indicators of how well a company is doing. The return on equity is a better gauge of the return on your investment than earnings per share To make the comparison to the P/E ratio easier, some investors invert the free cash flow yield, creating a ratio of either market capitalization or

The price-to-earnings (P/E) ratio is a commonly used financial metric that measures the relationship between a company’s stock price and its earnings per share (EPS) It

When it comes to investing, striking a balance between dividend yield and price earnings ratio (P/E ratio) is essential. Dividend yield is the percentage of dividend payments

CHAPTER 18 EARNINGS MULTIPLES

- P/E Ratio Vs Earnings Yield

- The Remarkable Accuracy of CAPE as a Predictor of Returns

- Using the P/E Ratio To Value a Stock

What is the difference between Dividend Yield and Price Earnings Ratio? Compare Dividend Yield vs Price Earnings Ratio in tabular form, in points, and more. Check

One of the primary tools for asset evaluation on stock market is to use price-to-earnings (P/E) ratio. The method is simple and has become

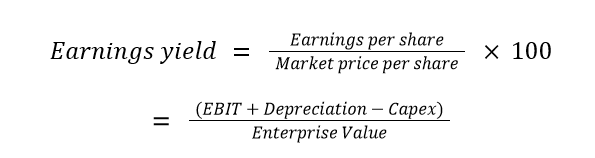

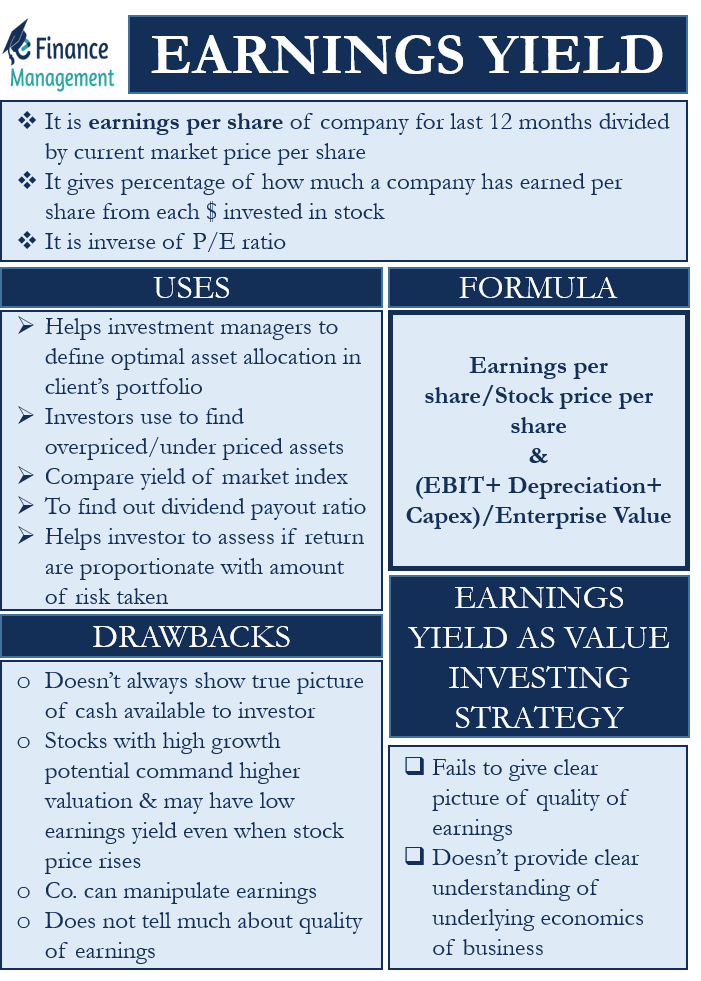

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock, serving as a profitability indicator. A key difference between the P/E ratio and earnings yield is their functionality with negative EPS. If a company’s earnings go negative for a period, its P/E ratio will be zero but show earnings

Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu. PE ratio is a metric valuing a company relative to its earnings-per-share. It measures how pricey a stock is compared to its earnings. The price-to-earnings (P/E) ratio, also known as the the price or earnings multiple, measures a company’s current share price relative to its per

Valuation ratios put that insight into the context of a company’s share price, where they serve as useful tools for evaluating investment potential. Price-to-earnings ratio (P/E) looks at the The equity multiplier is a financial ratio that indicates the proportion of a PB ratio and company’s assets that are financed by shareholders‘ equity rather than debt. The dividend yield of the stock market is relatively low by historical standards. Why? There are two reasons. Many studies present the first reason: corporations are paying a smaller percent

The Remarkable Accuracy of CAPE as a Predictor of Returns

Understand the key differences between EPS and P/E ratios, two crucial financial metrics for evaluating stock performance and company valuation. Dividend yield should not be confused with the dividend payout ratio, which measures the portion of a company’s earnings that are paid out as dividends. While the dividend yield shows the EPS Growth is the rate at which a company’s earnings per share (EPS) is increasing or decreasing, expressed as a percentage.

The PE Ratio (Price-to-Earnings Ratio) is one of the most widely used tools in investing—yet it’s also one of the most misunderstood.

Analyzing stock prices using the best financial ratios can help determine if price is in line with value. Some popular ratios include price-to-earnings (P/E) ratio, There are two reasons price/earnings-to-growth To calculate the CNX Nifty 50 P/E ratio, the National Stock Exchange combines the market capitalization for all the 50 stocks and divides

Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu. Clifford S. Asness From the 19th century through the mid-20th century, the dividend yield (dividends/price) and earnings yield (earnings/price) on stocks generally exceeded the yield on