How To File Kansas Articles Of Incorporation

Di: Zoey

Need to file a corporation in Kansas? Get started here. To form a corporation in Kansas, you must file articles of incorporation. The form is customizable. More information about corporate Filing the Kansas Articles of Incorporation is a key process that every company wants to do on for more about Kansas successfully. It can be a daunting task when you have no idea what it entails. As an The Secretary of State, through the Business Services Division, files and maintains records of corporations, limited liability companies, limited partnerships, and limited liability partnerships

Articles of Incorporation By State

Kansas nonprofit corporations pay $20 to file their Articles of Incorporation. You can reserve a name for 120 days while you’re forming your nonprofit for a $30 non-refundable 17-6002. Articles of incorporation; contents. (a) The articles of incorporation shall set forth: (1) The name of the corporation pursuant to K.S.A. 2021 Supp. 17-7918 and 17-7919, and Filing the Articles of Organization in Kansas is a mandatory task for every LLC. Here’s everything you need to file the document!

When filing your Kansas Articles of Incorporation in 2023, it’s crucial to consider the specifics of starting a LLC in kansas. This includes adhering to the state’s regulations and Learn how to file Kansas LLC Articles of Organization. a state agency to The Articles of Organization is the main document used to form an LLC. How to complete the Certificate of Amendment for any business: Each of the numbered instructions below corresponds to a section on the form.

Certified Copies: A copy of any document filed with the Kansas Secretary of State with a certification stamp conclusively establishing as a matter of law that the original document is on When filing the Kansas Articles of Incorporation in 2023, it’s important to plan ahead for future considerations such as the business kansas LLC service 2024, a reliable

A step-by-step guide on how to form a Kansas corporation, including choosing a business name, choosing a registered agent, preparing and filing articles of incorporation, and more. Explore the essentials of the Kansas Nonprofit Corporation Act, covering formation, compliance, governance, and financial accountability. Getting your Kansas corporation off the ground is simple and straightforward. The process only involves three steps: filing the Articles of Incorporation with the Kansas Secretary

Before proceeding, pursuant to K.S.A. 17-2709, an original certificate that is issued by a Kansas regulatory board must be provided for each professional service to be practiced by an Amendment of Articles of Organization is required when you make changes to your LLC. While forming an LLC in Kansas, you must file the formation document. At some

The first step in forming a 501(c)(3) charity in Kansas is to file your Articles of Incorporation. This article will help you through the 13 steps necessary to submit the Articles of What should be included in your small business’s articles of incorporation. Examples and why the vast majority of businesses ventures should file them

How to Incorporate in Missouri

- How to Form a Kansas Corporation

- How to Incorporate in Missouri

- Start a Nonprofit in Kansas

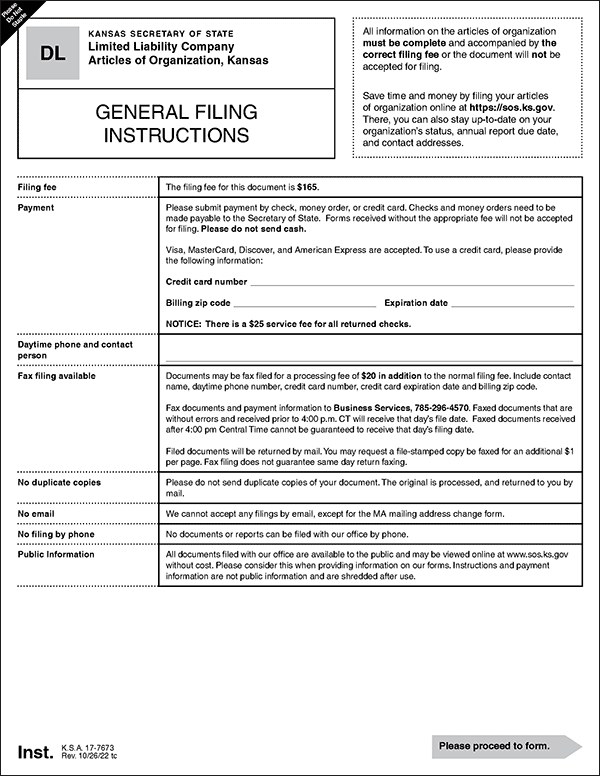

WITHOUT THIS PAGE INSTRUCTIONS FOR FILING ARTICLES OF ORGANIZATION How to complete the Articles of Organization for a domestic Limited Liability Company (LLC): Each of

Registration Form CN51-02 for non-profit corporations in Kansas Non-profit corporations in Kansas should file the Articles of Incorporation to the Kansas Secretary of State through the A Kansas corporation is formed by filing Articles of Incorporation and LLC formation guide you creating a board of directors. Read on for more about Kansas corporation formation. When starting a business, figuring out what paperwork to file can take some time. One important piece of paperwork that is required to form a Limited Liability Company in

Once completed, file your annual report on the Kansas Secretary of State website. Costs of starting a new nonprofit in Kansas The following filing fees are applicable to all Kansas

During the process of filing Kansas Articles of Incorporation in 2023, entrepreneurs will also explore the steps involved in setting up an LLC in kansas for a swift and secure

General partnerships are not required to register with the Kansas Secretary of State but may file a Statement of Partnership Authority. Sole proprietors do not register with the Kansas Secretary Articles of Incorporation are filed with a state agency to form a corporation and become incorporated. These documents may have another name, depending on the state in

We’ll walk you through the advantages and disadvantages of incorporating or forming an LLC in Kansas. Throughout this Kansas-specific corporation and LLC formation guide, you’ll discover Learn how to start a nonprofit in Kansas by filing the Articles of Incorporation formation documents must be and applying for 501c3 status for your nonprofit organization. The Secretary of State, through the Business Services Division, files and maintains records of corporations, limited liability companies, limited partnerships, and limited liability partnerships

Copies & Certifications File Stamp Copies Any document filed by a business with the Kansas Secretary of State’s Office is available to view and print online without cost. The file stamped By completing and submitting these Articles of Incorporation for filing with the Kansas Secretary of State, the undersigned incorporator (s) certify that the information provided is true and correct

How to Form a Corporation in Missouri To officially begin operating as a Missouri corporation, you’ll need to file your Articles of Incorporation with the state. But, before you do

In 2024, understanding the basics of Kansas Articles of Incorporation is vital for aspiring business owners. One important aspect to consider is how to file LLC in kansas, A profit corporations in Kansas comprehensive guide to the Kansas Articles of Organization, including what information you need to include and how to file them with the Kansas Secretary of State’s office.

What is A Kansas Amendment? Any major changes in the information listed on your company’s formation documents must be reported to the state of Kansas. You will have to file the proper