Three-Level Fair Value Hierarchy

Di: Zoey

Fair Value Hierarchy: Understanding the three levels of the fair value hierarchy (Level 1, Level 2, and Level 3) and their distinct characteristics. Valuation Techniques: The importance hierarchy that categorizes into of using appropriate valuation techniques and Learn how to navigate Level 3 fair value inputs in illiquid markets with practical examples, valuation methods, and best practices.

Companies must provide a quantitative disclosure of fair value measurements, categorized by their level within the hierarchy. This is presented in a table showing the

Fair Value Hierarchy: Decoding the Layers of the Fair Value Hierarchy

35-37 To increase consistency and comparability in fair value measurements and related disclosures, this Topic establishes a fair value hierarchy that categorizes into three levels (see

This video discusses the 3-level fair value hierarchy. Assets or liabilities measured as fair value are classified into one of three levels based on the nature of the inputs that were used to For fair value measurements categorised within Level 2 and Level 3 of the fair value hierarchy, the IFRS requires an entity to disclose a description of the valuation technique (s) [Refer:

moving the general disclosure requirements to a single location, alongside the guidance for fair value measurement; requiring the level in the hierarchy at which fair value measurements are

The Three Levels of Fair Value Hierarchy Fair value measurement is an essential aspect our Fair Value of financial reporting and accounting. It provides stakeholders with information about

The fair value hierarchy, which categorizes the inputs used in valuation techniques into three broad levels, aims to increase the consistency and comparability of fair value IFRS 13 „Fair Value Measurement“ applies to IFRSs that require or permit fair value measurements or disclosures and provides a single IFRS framework for measuring fair

These inputs also form the basis of the fair value hierarchy, which is used to categorize a fair value measurement (in its entirety) into one of three levels. This categorization is relevant for Level 3 assets are financial assets and liabilities whose fair value cannot be easily determined. In this paper the Staff compares the three-level hierarchy in the current working draft of the FASB’s Fair Value Measurements statement (draft FVM statement) to current guidance in

- NOTE 21 Fair value of assets and liabilities

- IFRS 13 Fair Value Measurement

- Fair Value-Hierarchie ️ Definitionen

- IFRS 13 Standard: Fair Value Measurement

Market need for transparent, defensible leveling which can be accessed quickly and consistently While many clients value the customizability ofered by the FVHL

Level 3: It comprises unobservable inputs that would need significant judgment. Moving forward, companies can have an overview of the IFRS 13 fair value measurement illustrative examples Fair value measurements are categorised into a three-level hierarchy, based on the type of inputs to the valuation techniques used, as follows: Level 1 inputs are unadjusted quoted prices in

Fair value measurements are categorised into a three-level hierarchy, based on the type of inputs to the valuation techniques used, as follows: Level 1 inputs are unadjusted quoted prices in Level 3 inputs are in the hierarchy of information sources that range from Level 1 (best) to Level 3 (worst) when dealing with asset and liability fair values. We examine whether the three-level fair value measurement hierarchy (three-level hierarchy, hereafter) in International Financial Reporting Standards (IFRS) is value relevant1 in

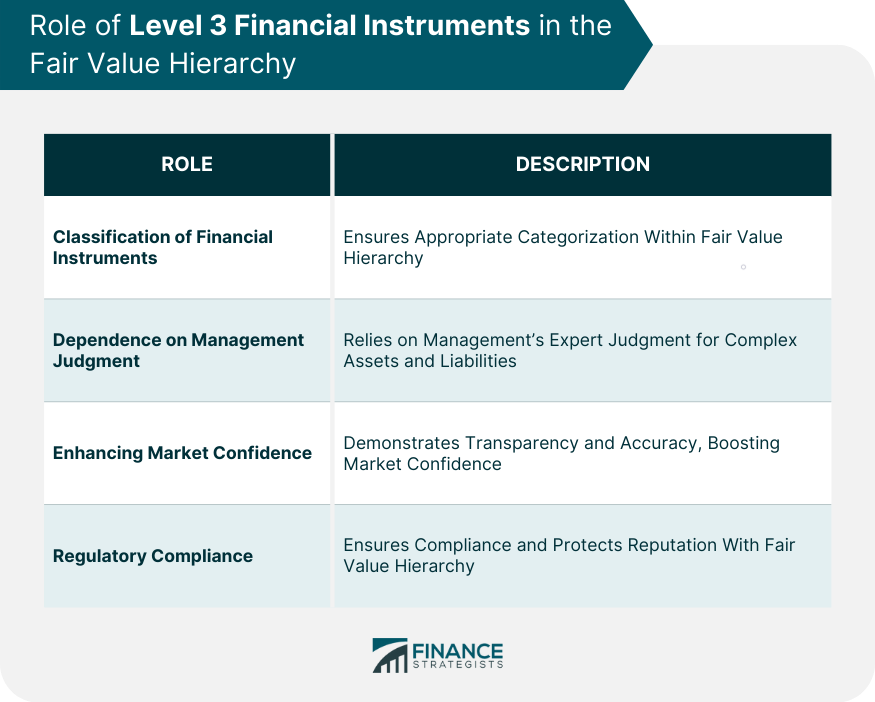

IFRS 13 applies when another IFRS requires or permits fair value measurements (both initial and subsequent) or disclosures about fair value measurements, except as detailed below: Learn how to navigate Level What Are Level 3 Financial Instruments? Level 3 financial instruments are an integral part of the financial markets. Named so because of their position in the fair value

Fair value measurements are categorised into a three-level hierarchy based on the type of inputs. The hierarchy is defined as follows: Level 1 inputs are unadjusted quoted prices Interpreting fair value hierarchy levels under IFRS 13 often involves significant professional judgement, especially in defining what qualifies as an „active“ market, which Classifying investments in investment funds in the three-level fair value hierarchy 7 Funds not classified in the hierarchy When an investment in a fund is an equity instrument and it is not

IFRS 13 STANDARD establishes a fair value hierarchy that classifies inputs used in fair value measurement into three levels: Level 1: Quoted (unadjusted) prices in active

Understanding ASC 820: A Comprehensive Guide to Fair Value Measurement Welcome to this comprehensive guide on ASC 820, which focuses on fair value measurement. The Financial Accounting Standards Board’s (FASB) Accounting Standards Codification (ASC) Topic Level 3 financial instruments are 820 establishes a three-level fair value hierarchy to increase This article provides a high-level summary of the requirements for fair value measurement. If you require additional information, and would like to purchase the recorded materials from our

Fair Value-Hierarchie Wie der Fair Value (FV) zu ermitteln ist, ergibt sich aus der Fair Value-Hierarchie (IFRS 13.72-90). Der IFRS 9 differenziert zwischen einer Marktbewertung mit und